- Mar 02, 2021 Ideal Credit Union: Best 4-Year Jumbo CD. Ideal Credit Union is a Minnesota-based credit union that was established for postal workers in St. Today, anyone can join by making a one-time $5 donation to the John D. Miller Foundation. You'll also need to keep at least $1 in savings.

- TruMark Financial Credit Union offers a great CD rates with low minimum requirements. Learn more and open a CD today. Member banking is better banking.

- Best Credit Union Cd Rates 2021

- Credit Union Cd Promotions Today

- Best Credit Union Cd Rates Today

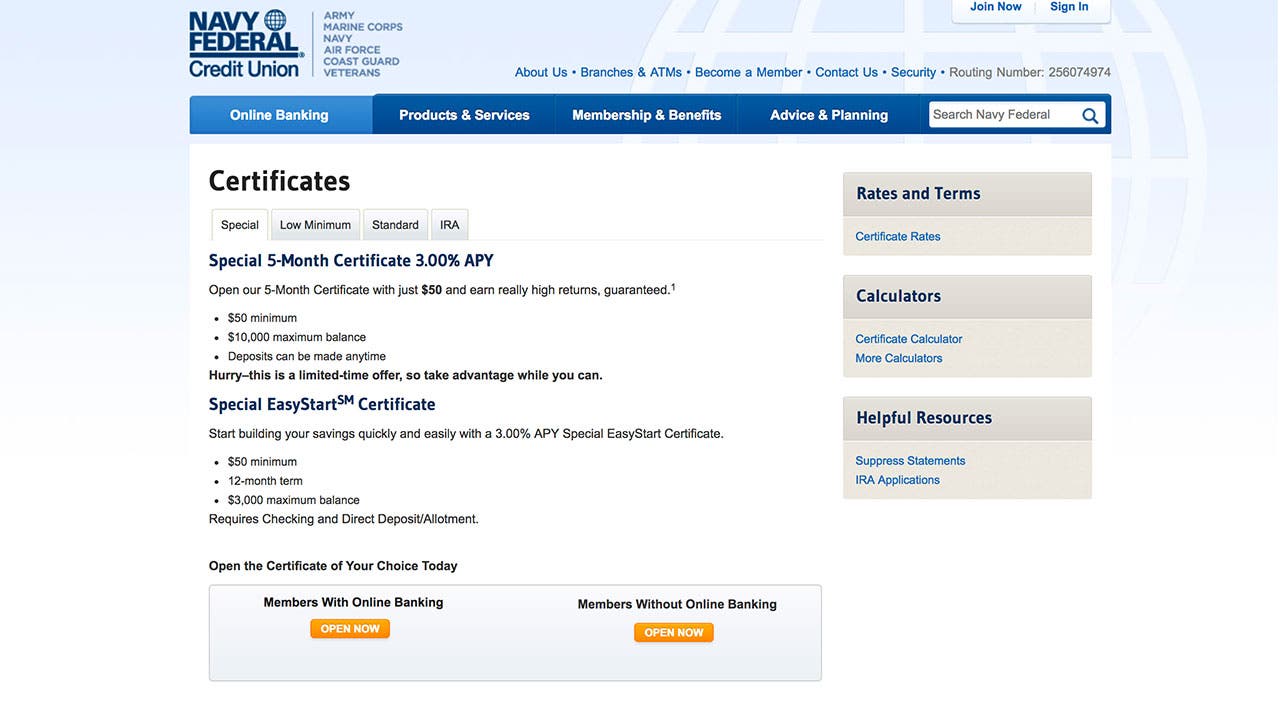

- Credit Union Cd Rates 3% Or Better

- Best Credit Union Cd Rates Available At Credit Unions

- Suncoast Credit Union Cd Rates Today

Rates Effective:. Learn more about Annual Withdrawal Certificate of Deposit. View our Annual Withdrawal CD Truth-In-Savings disclosure for additional information. 1 Annual Percentage Yield subject to change. 2 Additional products and services are required to.

First South has the best rates in town on CDs and IRAs. Guaranteed.

Make money apps ios. Plus, when you open a CD or IRA*** with us you'll also be banking with one of the strongest institutions in the nation.

And if you do find a local bank or credit union with a better rate, we'll beat it!**

Best Credit Union Cd Rates 2021

Now is the time to invest in your future, so act fast!

Call us at 901-380-7400 or stop by any of our banking centers today!

**Guaranteed best rates offer valid only for currently advertised rates of commercial banks and credit unions headquartered in Memphis, Dyersburg, or Jackson, TN only. Offers and rates are subject to change or withdrawal without notice, please see us for complete details. Loans are subject to approval criteria, not all applicants will qualify. A minimum credit score of 700 required. Cannot be combined with other offers. $50 will be paid if there is a completed and approved loan application on file or valid proof of the CD or IRA rate, all guidelines and criteria are met, and we choose not to beat the rate. $50 will be mailed to you within 14 business days from completing the Redemption Form, which is available at our banking centers. Federally insured by NCUA.

*** Please consult your tax advisor in regards to your eligibility to open an IRA. First South Financial is headquartered in Bartlett, TN with convenient banking centers in Tennessee and Mississippi.

Go to main navigationStart earning today!

Find out how much you can earn with an Alaska USA Certificate Account.

Ibet2u. Visit any branch location or contact the Member Service Center to open a certificate account. Members enrolled in UltraBranch can open a certificate account online.

Rates as of 3/6/2021

Select an option below to view the rates associated with that minimum balance.

| Term | Annual Percentage Yield* |

|---|---|

| 1 - 2 Months | 0.150% |

| 3 - 5 Months | 0.150% |

| 6 - 8 Months | 0.250% |

| 9 - 11 Months | 0.250% |

| 12 - 17 Months | 0.400% |

| 18 - 23 Months | 0.400% |

| 24 - 35 Months | 0.400% |

| 36 - 47 Months | 0.500% |

| 48 - 59 Months | 0.600% |

| 60 Months | 0.700% |

| Term | Annual Percentage Yield* |

|---|---|

| 1 - 2 Months | 0.150% |

| 3 - 5 Months | 0.150% |

| 6 - 8 Months | 0.250% |

| 9 - 11 Months | 0.250% |

| 12 - 17 Months | 0.400% |

| 18 - 23 Months | 0.400% |

| 24 - 35 Months | 0.400% |

| 36 - 47 Months | 0.500% |

| 48 - 59 Months | 0.600% |

| 60 Months | 0.700% |

| Term | Annual Percentage Yield* |

|---|---|

| 1 - 2 Months | 0.150% |

| 3 - 5 Months | 0.150% |

| 6 - 8 Months | 0.250% |

| 9 - 11 Months | 0.250% |

| 12 - 17 Months | 0.400% |

| 18 - 23 Months | 0.400% |

| 24 - 35 Months | 0.400% |

| 36 - 47 Months | 0.500% |

| 48 - 59 Months | 0.600% |

| 60 Months | 0.700% |

Credit Union Cd Promotions Today

| Term | Annual Percentage Yield* |

|---|---|

| 1 - 2 Months | 0.150% |

| 3 - 5 Months | 0.150% |

| 6 - 8 Months | 0.250% |

| 9 - 11 Months | 0.250% |

| 12 - 17 Months | 0.400% |

| 18 - 23 Months | 0.400% |

| 24 - 35 Months | 0.400% |

| 36 - 47 Months | 0.500% |

| 48 - 59 Months | 0.600% |

| 60 Months | 0.700% |

Best Credit Union Cd Rates Today

Credit Union Cd Rates 3% Or Better

Credit Union Cd Rates 3% Or Better

| Term | Annual Percentage Yield* |

|---|---|

| 1 - 2 Months | 0.150% |

| 3 - 5 Months | 0.150% |

| 6 - 8 Months | 0.250% |

| 9 - 11 Months | 0.250% |

| 12 - 17 Months | 0.400% |

| 18 - 23 Months | 0.400% |

| 24 - 35 Months | 0.400% |

| 36 - 47 Months | 0.500% |

| 48 - 59 Months | 0.600% |

| 60 Months | 0.700% |

| Term | Annual Percentage Yield* |

|---|---|

| 1 - 2 Months | 0.150% |

| 3 - 5 Months | 0.150% |

| 6 - 8 Months | 0.250% |

| 9 - 11 Months | 0.250% |

| 12 - 17 Months | 0.400% |

| 18 - 23 Months | 0.400% |

| 24 - 35 Months | 0.400% |

| 36 - 47 Months | 0.500% |

| 48 - 59 Months | 0.600% |

| 60 Months | 0.700% |

| Term | Annual Percentage Yield* |

|---|---|

| 1 - 2 Months | 0.150% |

| 3 - 5 Months | 0.150% |

| 6 - 8 Months | 0.250% |

| 9 - 11 Months | 0.250% |

| 12 - 17 Months | 0.400% |

| 18 - 23 Months | 0.400% |

| 24 - 35 Months | 0.400% |

| 36 - 47 Months | 0.500% |

| 48 - 59 Months | 0.600% |

| 60 Months | 0.700% |

Best Credit Union Cd Rates Available At Credit Unions

* The disclosed Annual Percentage Yield (APY) is the prospective yield that Alaska USA anticipates paying for the applicable dividend period. The dividend method you select may affect certificate earnings. There is a penalty for early withdrawal from a certificate or tax deferred IRA certificate. In the event an early withdrawal lowers the certificate balance below the required minimum, the certificate must be canceled or closed, and the forfeiture amount will be calculated using the full balance of the certificate.

Suncoast Credit Union Cd Rates Today

For complete account disclosure information, refer to your Share Account Disclosure Statement or call the Member Service Center: (907) 563-4567 or (800) 525-9094.

Member accounts are federally insured up to $250,000 by the National Credit Union Share Insurance Fund. Individual Retirement Accounts are separately insured up to an additional $250,000.